Why Every W-2 Worker Should Start an LLC in 2026 — Even If You Don’t Plan to Start a “Business”

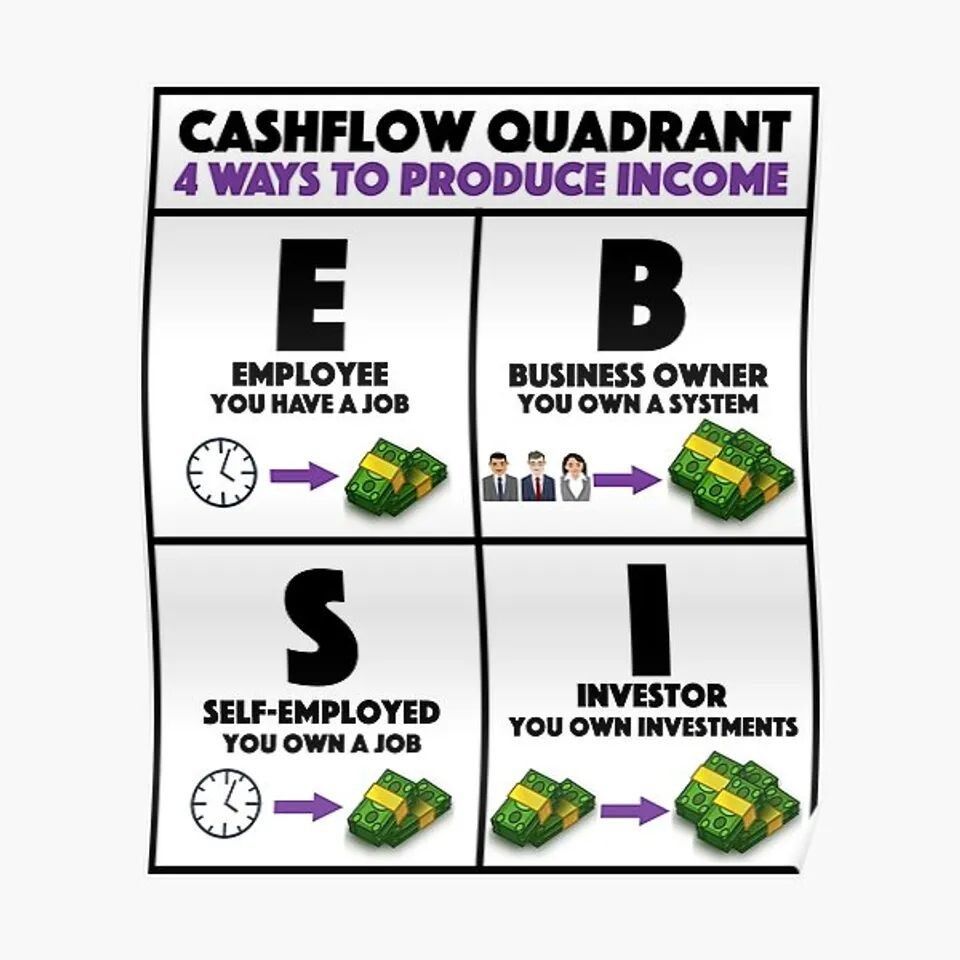

Most people were raised to think:

“Get a job. Work hard. Save money. Retire.”

But in today’s world? That model keeps people broke, stressed, and living on razor-thin margins.

Meanwhile… The tax code rewards business owners, creators, and entrepreneurs.

Here’s the wake-up call:

⭐ If you are a W-2 employee with no LLC, you are paying MORE taxes than you need to — and leaving thousands of dollars on the table every year.

This isn’t theory. This is the IRS tax code. This is real life.

Let’s break it down.

🔥 1. W-2 Workers Are Taxed at the Highest Possible Rate

When you get a paycheck as a W-2 employee:

- Taxes come out first

- You live on what’s left

- You have almost NO deductions

- You can’t write off tools, books, learning, mileage, equipment, phone, travel, etc.

Meanwhile, business owners:

- Spend first

- Deduct expenses

- Pay taxes on what’s left

It’s a different universe.

🔥 2. An LLC Lets You Tap Into Business Deductions — Even If You Only Earn $500–$1,000

The IRS allows you to deduct legitimate startup and business-related expenses, such as:

- Laptop

- Phone

- Home office

- Mileage

- Education

- Courses

- Coaching

- Equipment

- Software

- AI tools

- Marketing

- Travel for business purposes

This means:

⭐ An LLC immediately gives you access to the tax advantages of entrepreneurship — even while keeping your W-2 job.

You don’t need a massive company. You don’t need employees. You don’t need a huge idea. You just need a structure.

https://www.manfreandassociates.com/

🔥 3. Having an LLC Forces You to Think Like a Business — Not Just an Employee

When you get your EIN and start an LLC, something shifts mentally:

You start asking:

- How do I increase my income?

- How do I build assets?

- How do I deliver value?

- How do I build skills that pay?

- How do I turn my knowledge into a service?

An LLC isn’t just a tax move. It’s a mindset shift into becoming an asset builder.

🔥 4. Every Skill You Learn Becomes Tax-Deductible When You’re a Business

- Sales

- Marketing

- AI

- Leadership

- Communication

- Technical skills

- Consulting

- Coaching

When you’re an employee, learning these is a luxury. When you own an LLC, they are business investments.

https://www.manfreandassociates.com/digital-marketing-solutions

🔥 5. Starting a Simple LLC Is the Easiest Path to More Money, More Freedom, and More Options

You don’t have to start big.

You can start with:

- A side service

- Weekend consulting

- A digital product

- A micro-offer

- A YouTube channel

- Editing, coaching, cleaning, design, writing — ANYTHING

Or nothing yet.

The point is the entity gives you:

- Tax advantages

- Credibility

- Protection

- Opportunity

- A foundation to grow

⭐ The Real Goal: Stop Living Only as a Consumer — Start Operating As a Producer

Most W-2 employees:

- Borrow money

- Pay taxes

- Pay interest

- Have limited financial tools

Business owners:

- Create value

- Deduct expenses

- Build assets

- Multiply opportunity

It’s time for W-2 workers to step into the new era.

🔥 Final Thought

You don’t need permission. You don’t need a perfect plan. You don’t need a 50-page business model.

You just need to start.

The moment you build your LLC… You stop being just an employee and start becoming an asset builder.

I write this article to offer help and guidance on this journey.

Learn more of how I can help you start running your brand and life like a business.

Build Your Brand. Automate Your Business. Create Daily Income with AI — Starting Today.

In today’s world, the people who win are the ones who know how to build their brand, automate their systems, and use AI to multiply their time.

This step-by-step blueprint shows you exactly how to do it — even if you're starting from zero.