Unlock Hidden Cash Flow with Cost Segregation: How It Works and What It Creates

Unlock Hidden Cash Flow with Cost Segregation: How It Works and What It Creates

🏠💸 What If I Told You Your Building Could Be Putting More Cash in Your Pocket… Right Now?

Most property owners don’t realize their biggest asset is also their biggest untapped resource. If you own investment property or commercial real estate, you might be leaving tens — sometimes hundreds — of thousands of dollars in tax benefits on the table.

The tool to unlock this? ➡️ Cost Segregation.

📊 What Is Cost Segregation?

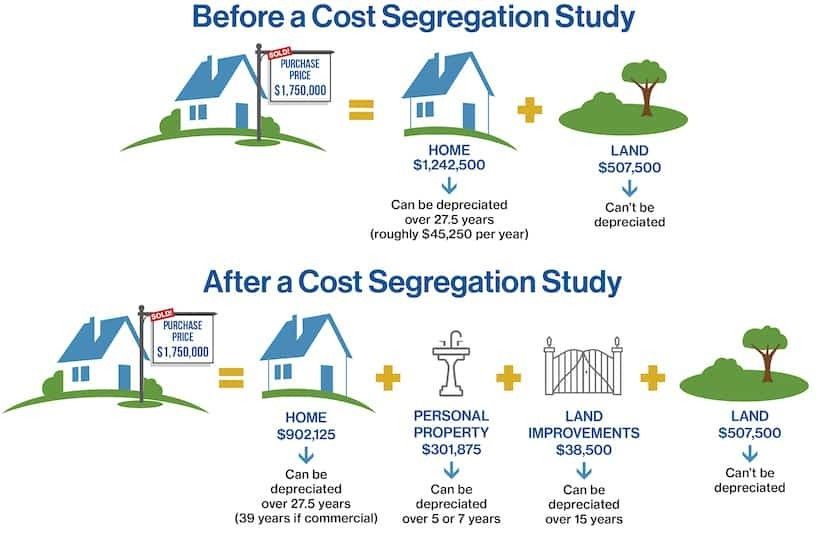

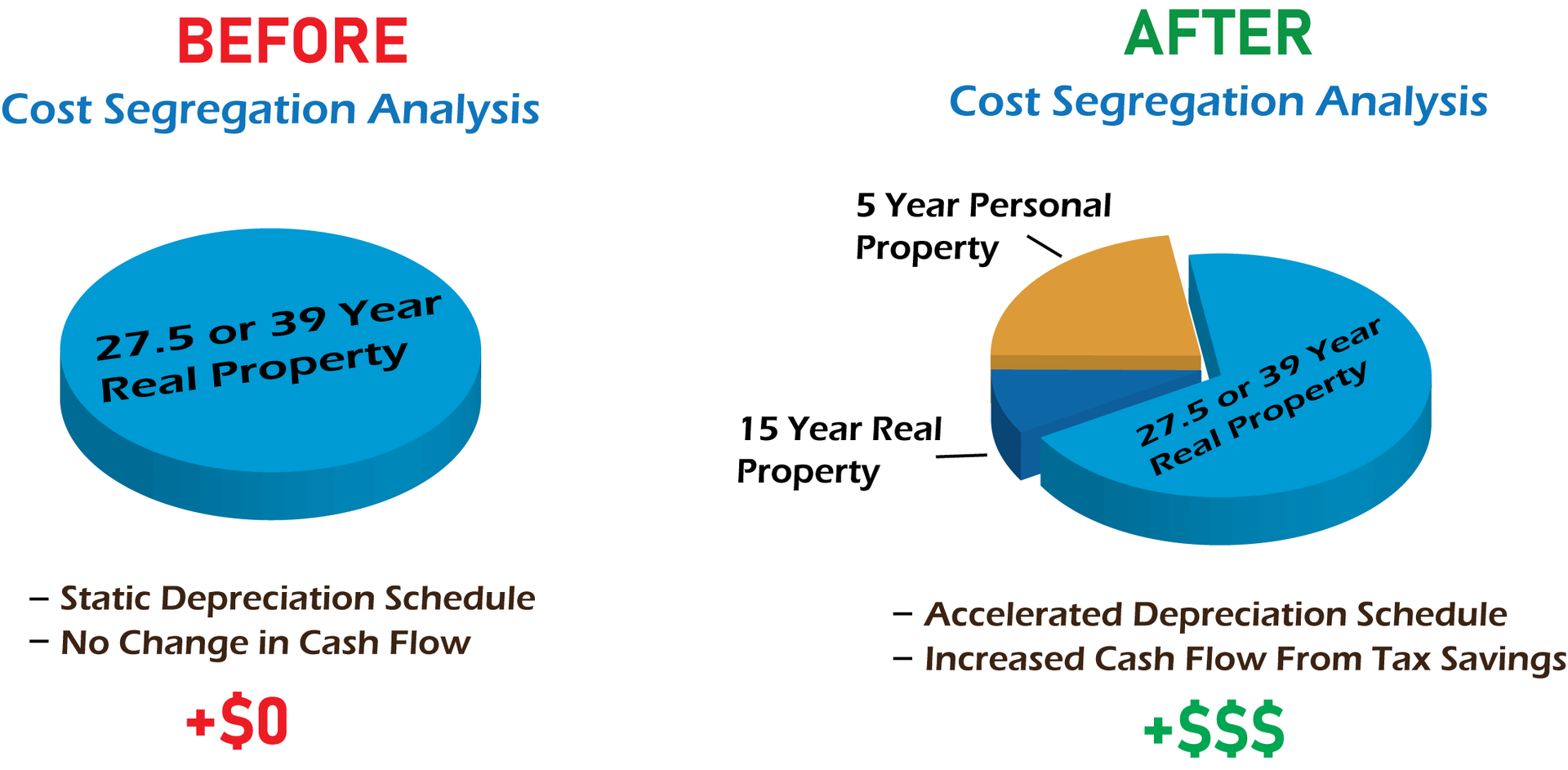

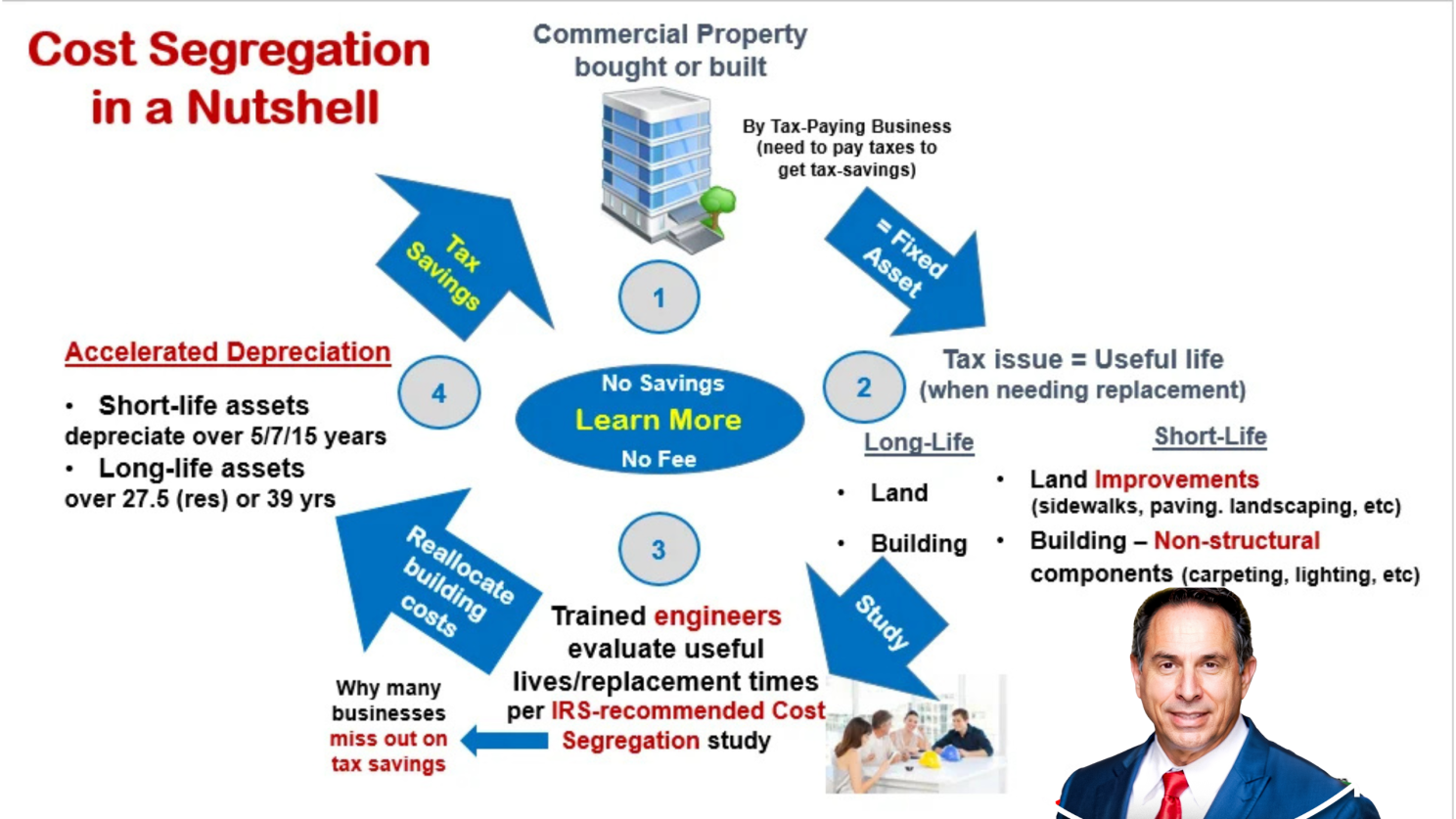

Cost segregation is a strategic tax planning tool that allows real estate owners to accelerate depreciation deductions by reclassifying certain building components and improvements as personal property or land improvements, which can be depreciated over 5, 7, or 15 years instead of the standard 27.5 or 39 years.

In simple terms: It’s a way to front-load your tax savings — turning future deductions into immediate cash flow.

💬 Why I’m Sharing This With You

Over the years, working with business owners, investors, and everyday families, I’ve seen one constant: People often leave life-changing opportunities on the table simply because no one ever told them they existed.

I’m passionate about helping people live more financially empowered, secure, and purposeful lives. Not because it sounds good in a marketing pitch — but because I’ve experienced what happens when you don’t know what you don’t know.

This is why I share resources like cost segregation studies, tax-saving strategies, business growth systems, and financial education tools. I believe every person deserves access to the same high-level, wealth-building knowledge that’s typically reserved for the ultra-wealthy or big corporations.

My mission is simple: 👉 To educate. 👉 To empower. 👉 To help you build a stronger, more secure, and opportunity-filled future for yourself and your family.

If a tool exists that can free up your cash flow, reduce stress, and give you more options in life — you deserve to know about it.

That’s why I do this. And I’m just getting started.

⚙️ How Does It Work?

✔️ A qualified engineering-based study breaks down your property into different components: • Structural (39-year) • Land improvements (15-year) • Personal property (5 or 7-year)

✔️ Components like flooring, lighting, cabinetry, parking lots, signage, fencing, and landscaping can be depreciated much faster.

✔️ These deductions reduce taxable income, resulting in significant tax deferrals and improved cash flow — especially powerful in the first few years of ownership.

💥 The Benefits:

✅ Increased Cash Flow: Reduce current tax liabilities and reinvest the savings.

✅ Reduced Taxable Income: Lower your taxable income by accelerating depreciation deductions.

✅ Improved ROI: Use tax savings to improve your property, pay down debt, or expand your portfolio.

✅ Bonus Depreciation: Under current tax laws (subject to change), you may also be able to deduct 60% of qualifying property in year one (2025).

✅ Great for New Purchases, Renovations, and Existing Properties: It’s not just for new acquisitions — you can apply it retroactively to properties acquired in prior years.

📚 What Resources Does It Create?

A properly executed cost segregation study provides more than just a tax break. It creates:

🔍 A Detailed Engineering Report Breaks down your building’s components with values assigned to each category.

📈 Cash Flow Projections Shows how much money you’ll save now vs. over 39 years.

📝 Audit-Ready Documentation Prepared for IRS review, reducing risk in case of an audit.

📊 Opportunities for Strategic Tax Planning Pair with 1031 exchanges, estate planning, or business growth strategies.

💸 Unlocks Access to Capital Use tax savings to fund property improvements, business expansions, or new acquisitions.

📌 Who Should Consider a Cost Segregation Study?

- Commercial property owners

- Residential rental property investors

- Businesses with owned real estate

- Anyone buying, building, or renovating property over $250,000 in value

🚀 Final Thought:

Most property owners overpay their taxes — not because of bad accounting, but because they’re not using the right tools.

Cost segregation is one of the smartest ways to legally reduce tax liability, improve cash flow, and build wealth faster.

Now is the perfect time to consider a study, especially with evolving tax laws on the horizon.

📞 Want to See How Much You Could Save?

I can connect you with our trusted cost segregation specialists and CPAs who can provide a free preliminary analysis of your property.

Reply to this email or DM me "COST SEG STUDY" to get started.

Book a Discovery Call:

Click Here

Licensed in all areas of Insurance 30 years Property and Casualty, Health / Life.

Licensed Real Estate Associate for 25 years

Learn More About Our Services:

www.manfreandassociates.com