The Results Revolution: Your Blueprint for Financial Freedom, Cashflow, and Lasting Wealth

Welcome to the Results Revolution

If you’re reading this, you’re not here for average. You’re not here for “just enough.” You’re here because you want more—more freedom, more cashflow, more options, and a life that’s not dictated by debt or dead-end routines.

You want to see real results, and you’re ready to do what it takes.

This newsletter is your blueprint. It’s not just about motivation (though you’ll get plenty of that).

It’s about actionable steps, proven systems, and the mindset shifts required to break free from debt, build above-average cashflow, and set yourself up for a retirement that’s not just possible, but inevitable. And yes, we’ll talk about the power of subscription models and why learning new skills is your secret weapon.

Let’s get started.

I am writing this specifically to those who are tired of trying to figure things out and really want the actual steps and guidance. So many people are seeking for genuine truth to change their financial situations but lack strategy and the right vehicles to achieve.

1. The Mindset Shift: From Scarcity to Abundance

Before we dive into strategies and systems, let’s talk about the foundation: your mindset.

Most people are stuck in a scarcity loop. They believe money is hard to come by, that debt is just a part of life, and that “retirement” is a distant dream reserved for the lucky few. But here’s the truth: your beliefs shape your reality. If you want different results, you need to start thinking differently.

Action Step: Write down your current beliefs about money, debt, and wealth. Be honest. Then, challenge each one.

For example, if you believe “I’ll always be in debt,” ask yourself, “Is that really true?

What evidence do I have?

What if the opposite were possible?”

This is the first step to rewiring your financial future.

2. Escaping the Debt Trap: Your Step-by-Step Plan

Debt is the enemy of freedom. It drains your energy, limits your choices, and keeps you stuck in survival mode. But escaping debt isn’t just about cutting expenses—it’s about creating a plan and sticking to it.

Step 1: Know Your Numbers List every debt you have: credit cards, student loans, car payments, personal loans. Write down the balance, interest rate, and minimum payment for each.

Step 2: The Avalanche or Snowball? There are two main strategies for paying off debt:

- Avalanche Method: Pay off debts with the highest interest rate first. This saves you the most money in the long run.

- Snowball Method: Pay off the smallest debts first for quick wins and motivation.

Pick the one that fits your personality. The best method is the one you’ll stick with.

Step 3: Automate and Attack Set up automatic payments for minimums on all debts. Then, throw every extra dollar at your target debt. Sell unused items, pick up a side gig, or cut unnecessary subscriptions (more on that later).

Step 4: Celebrate Milestones Every time you pay off a debt, celebrate. This keeps you motivated and reinforces your progress.

Step 5: Don’t Go Back Once a debt is paid off, don’t rack it up again. Cut up cards if you have to. Build an emergency fund to avoid future debt.

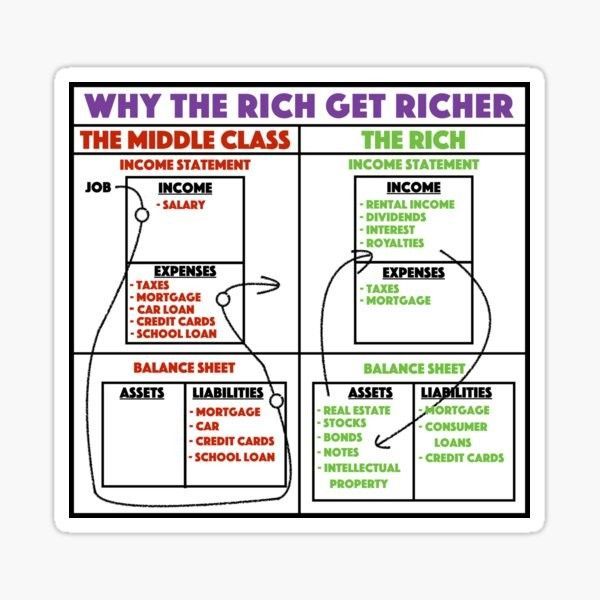

3. Building Above-Average Cashflow: The Power of Multiple Streams

Getting out of debt is just the beginning. The real game-changer is building cashflow—money that comes in whether you’re working or not. The wealthy don’t rely on a single paycheck. They build multiple streams of income.

A. The Subscription Model: Your Secret Weapon

Subscription models are everywhere for a reason—they work. Think Netflix, Spotify, meal kits, software, even monthly sock deliveries. Why? Because they create predictable, recurring revenue.

But here’s the twist: instead of just being a consumer, become a creator.

How to Start Your Own Subscription Model:

- Identify a Need: What do people need or want on a regular basis? This could be physical products (like coffee or skincare), digital content (newsletters, courses, exclusive communities), or services (coaching, consulting, maintenance).

- Start Small: You don’t need a massive audience. Even 50 subscribers at$20/month is$1,000/month in recurring revenue.

- Automate Delivery: Use platforms like Patreon, Substack, Shopify, or Kajabi to handle payments and content delivery.

- Focus on Value: The key to retention is delivering consistent value. Ask for feedback, improve your offering, and make your subscribers feel special.

B. Other Cashflow Ideas:

- Digital Products: E-books, templates, online courses, or printables.

- Affiliate Marketing: Promote products you love and earn a commission.

- Real Estate: Rental properties or Airbnb.

- Investing: Dividend stocks, REITs, or peer-to-peer lending.

- Freelancing: Use your skills to take on projects in your spare time.

Action Step: Pick one cashflow idea and commit to launching it in the next 30 days. Don’t overthink it—progress beats perfection.

At this point you may already know what you want or still not sure. This is an example of a community of over 54,000 members that have started and learning everyday within and many are achieving results. CLICK HERE learn more.

4. Systems for Wealth: Automate, Delegate, Elevate

Wealth isn’t built by working harder—it’s built by working smarter. The secret? Systems.

A. Automate Your Finances

Automatic Savings: Set up automatic transfers to savings and investment accounts. Treat savings like a bill you must pay.

Bill Pay: Automate recurring bills to avoid late fees and stress.

Budgeting Apps: Use tools like YNAB, Mint, or Personal Capital to track spending and stay on target.

B. Delegate and Outsource

As your cashflow grows, your time becomes more valuable. Delegate tasks that don’t require your unique skills. Hire a virtual assistant, use automation tools, or outsource chores. This frees you up to focus on high-impact activities.

C. Elevate with Ongoing Subscriptions

Invest in subscriptions that make you money or save you time. This could be business tools, educational platforms, or networking groups. The right subscriptions are investments, not expenses.

5. The Power of Learning: New Skills, New Results

The world is changing fast. The skills that got you here won’t get you where you want to go. The most successful people are lifelong learners.

A. Identify High-ROI Skills

Focus on skills that directly impact your income and freedom. Examples include:

- Digital marketing

- Sales and negotiation

- Copywriting

- Coding or web development

- Investing and financial literacy

- Public speaking

- Content creation (video, podcasting, writing)

B. Learn by Doing

Don’t just consume information—apply it. Launch a mini-project, take on a freelance gig, or teach what you learn. Action creates clarity and confidence.

C. Invest in Yourself

Buy books, take courses, attend workshops, join masterminds. The best investment you’ll ever make is in your own growth.

Action Step:

Pick one new skill to learn this month. Block out time on your calendar and commit to daily practice.

6. Setting and Achieving Goals: The Results Formula

Dreams are great, but goals get results.

A. Get Specific

Vague goals get vague results. Instead of “I want to be debt-free,” say “I will pay off$10,000 in credit card debt by December 31st.”

B. Break It Down

Divide big goals into smaller, actionable steps. If your goal is to launch a subscription business, your steps might be: research ideas, pick a platform, create your first product, get your first subscriber.

C. Track Progress

What gets measured gets managed. Use a journal, spreadsheet, or app to track your progress. Review weekly and adjust as needed.

D. Stay Accountable

Share your goals with a friend, mentor, or accountability group. Regular check-ins keep you on track.

E. Celebrate Wins

Every milestone matters. Celebrate progress, no matter how small. This builds momentum and keeps you motivated.

7. Real Stories, Real Results

Let’s look at a few real-world examples of people who’ve transformed their lives using these principles:

Case Study 1: From Debt to Freedom

Sarah was drowning in$30,000 of credit card debt. She started with the snowball method, paying off her smallest debt first. She picked up a weekend side gig and sold unused items online. Within 18 months, she was debt-free. The best part? She kept her side gig and started investing the extra cash.

Case Study 2: Subscription Success

Mike loved fitness and started a$15/month online workout group. He used Facebook and Zoom to deliver live classes and built a small but loyal community. Within a year, he had 120 subscribers$1,800/month in recurring revenue. He now works part-time and spends more time with his family.

Case Study 3: Learning Pays Off

Jasmine was stuck in a low-paying job. She decided to learn digital marketing through free online courses and YouTube. She started freelancing on the side, built a portfolio, and within a year, landed a remote job that doubled her income.

8. Your Next Steps: Take Action Today

Reading this newsletter is a great start, but results come from action. Here’s your challenge:

- Pick one area to focus on this month: Debt, cashflow, systems, or learning a new skill.

- Set a specific, measurable goal.

- Break it down into weekly action steps.

- Track your progress and celebrate every win.

- Share your journey with someone who will hold you accountable.

Remember, you don’t have to do everything at once. Consistent, focused action beats scattered effort every time.

9. Resources to Accelerate Your Journey

Here are some tools and resources to help you get started:

- Budgeting: YNAB, Mint, Personal Capital

- Learning: Coursera, Udemy, Skillshare, YouTube

- Subscription Platforms: Patreon, Substack, Shopify, Kajabi

- Accountability: Mastermind groups, online forums, local meetups

- Books: The Total Money Makeover by Dave Ramsey Rich Dad Poor Dad by Robert Kiyosaki Atomic Habits by James Clear The 4-Hour Workweek by Tim Ferriss

10. Final Thoughts: The Results Revolution Starts With You

You have everything you need to create the life you want. The path to financial freedom, above-average cashflow, and a secure retirement isn’t reserved for the lucky or the privileged—it’s available to anyone willing to learn, take action, and stay the course.

The world is full of opportunities. Subscription models, digital products, new skills, and smart systems are all within your reach. The only thing standing between you and your goals is the decision to start.

So, what will you do today? Will you keep wishing, or will you join the Results Revolution and take the first step toward the life you deserve?

Your future self is cheering you on. Let’s make it happen—together.

P.S. If you found this newsletter valuable, share it with a friend who’s ready to level up. And if you want more tips, tools, and real-world strategies, stay tuned for my next issue—where we’ll dive deeper into building unstoppable momentum and multiplying your results.

To your success,

Rene' Paul Manfre