The Real-Life Wealth Blueprint – A New Way to Build and Protect Wealth

Why I Am Writing This

"I’m writing this because, as I’ve moved into my later years, my daily conversations have become much deeper and more serious. Every day, I talk to seniors who are living the reality of the choices they made decades ago. I hear the raw, heavy frustration in their voices when they realize that despite working hard for 40 years, they are still exposed.

They have 'pieces' of a plan, but they don't have security. I see the pitfalls they fell into—the gaps in insurance that are now unfixable, the lack of real estate that could have provided steady income, and the missed tax opportunities that could have saved them a fortune. I’ve seen enough of these struggles to know that 'good enough' planning isn't enough.

I’m sharing this blueprint because I want to turn the frustrations I hear daily into a roadmap for you, so you don't have to have those same hard conversations twenty years from now."

After more than 30 years in business, insurance, lending, and real estate, and working with thousands of clients through booms, busts, and everything in between, I’ve learned something important:

Most people don’t have a real plan for wealth and retirement. They have pieces.

- An insurance policy they bought years ago.

- A 401(k) at work.

- Maybe a house.

- Maybe a rental or a side business.

Each of those pieces might be fine on its own—but they’re rarely designed to work together.

That’s where problems (and missed opportunities) show up.

I’ve sat across the table from families and business owners who did “everything right” according to traditional advice and still felt one medical issue, one job loss, or one lawsuit away from starting over.

Over time, I realized the problem wasn’t them. The problem was the siloed way our industry gives advice.

- Insurance agents focus on policies.

- Real estate agents focus on transactions.

- Lenders focus on closing loans.

- CPAs focus on last year’s taxes.

- Investment advisors focus on portfolios.

Very few people are looking at the entire picture of how a real family builds, protects, and lives off wealth in the real world.

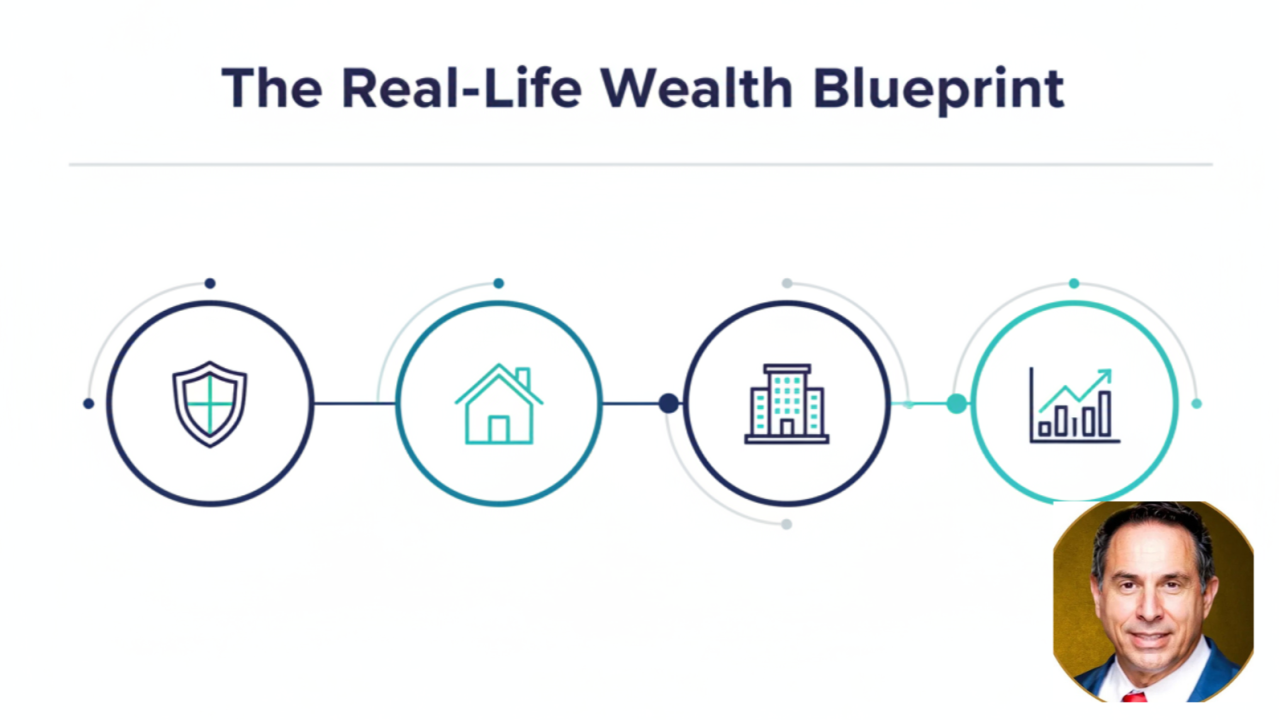

That’s why I started developing what I now call the

Real-Life Wealth Blueprint™.

The Real-Life Wealth Blueprint™: Four Pillars, One Plan

From decades of experience on all sides—consumer, lender, agent, investor, and business owner—I’ve seen that long-term financial security usually comes from four main “pillars.”

Most people are strong in one or two and weak or exposed in the others.

Those four pillars are:

- The Protection Pillar (Insurance & Risk Management)

- The Property Pillar (Real Estate)

- The Enterprise Pillar (Business & LLCs)

- The Capital Pillar (Savings & Investments)

Think of your financial life like a table. If it only has one leg—say, a 401(k)—it doesn’t take much to knock it over. The more solid, coordinated legs you have, the more stable your future becomes.

Let’s walk through each pillar.

Pillar 1: The Protection Pillar (Insurance & Risk Management)

Most people have some insurance. Very few have coordinated protection.

Over the years I’ve reviewed countless policies where:

- The life insurance wasn’t enough to truly protect the family.

- The disability protection was missing entirely.

- The health coverage had gaps that could create huge out-of-pocket costs.

- The auto/home/umbrella coverage left major liability exposures.

Insurance is not exciting, but it’s the foundation that keeps everything else from collapsing when life happens.

A strong Protection Pillar answers questions like:

- If I were disabled and couldn’t work for 6–12 months, what happens?

- If I died prematurely, would my family keep the house, the business, the lifestyle?

- If I caused a serious accident, are my personal assets exposed?

- If I get sick, will medical bills eat into my retirement plan?

In my experience, this pillar is often underbuilt, not because people don’t care—but because each policy was bought in isolation, not as part of a blueprint.

Pillar 2: The Property Pillar (Real Estate)

I’ve been licensed in real estate for over 25 years, and I’ve seen the full cycle: from people buying at the top of a hot market to others picking up great properties when times are tough.

Real estate is one of the most powerful tools families can use to:

- Build equity.

- Create inflation-resistant income.

- Access tax advantages that traditional investments don’t offer.

The Property Pillar might include:

- Your primary residence and the strategy around it (paydown vs. refi vs. move).

- A first rental property or small portfolio.

- A vacation home that can double as part-time rental.

- Small multi-family properties or even passive real estate investments.

I’ve seen many clients with great incomes and strong work ethic, but all of their wealth is sitting in two places: their 401(k) and their home. Adding even one or two well-chosen income properties can transform the retirement picture.

But again, real estate has to fit into an integrated blueprint—not just be a “random rental” they hope works out.

Pillar 3: The Enterprise Pillar (Business & LLCs)

This is the pillar most traditional advisors either ignore or barely touch—and it’s often where the biggest opportunities live.

Over 30 years in this world, I’ve come to a strong belief:

Most households can benefit from at least one properly structured LLC or business entity, as long as there is a legitimate business or investment purpose behind it.

Why?

Because business and entities can:

- Turn your skills and time into income and equity, not just a paycheck.

- Open up tax strategies unavailable to W‑2-only households.

- Separate risk between your personal world and your business or real estate.

- Create something you can eventually scale, sell, or pass on.

Your Enterprise Pillar might be:

- A consulting or service business.

- A small local business.

- A rental property business held in an LLC.

- A side business around something you already know how to do.

An LLC is not a magic tax trick or a shield that lets you do anything you want. It needs to be set up correctly, used correctly, and coordinated with your tax and legal professionals.

But when part of a Real-Life Wealth Blueprint, a business or LLC can dramatically increase your flexibility, your opportunities, and your long-term wealth.

Pillar 4: The Capital Pillar (Savings & Investments)

This is the pillar most people think of when they hear “financial planning”:

- 401(k)s and 403(b)s

- IRAs and Roth IRAs

- Brokerage accounts

- Mutual funds, ETFs, and other investments

This pillar is important. You want:

- Liquidity (cash and easily accessible funds).

- Diversification (not all eggs in one basket).

- Growth over time to outpace inflation.

The issue is not that this pillar is bad—it’s that for many people, it’s the only pillar anyone has seriously discussed with them.

If all you have is a pile of statements and no clear plan for how your accounts support and interact with your insurance, real estate, and business… you don’t have a blueprint, you have a collection.

The Real Problem: Siloed Advice

Here’s what I’ve seen over and over with real clients:

- The insurance agent sold a policy that made sense by itself, but didn’t coordinate with the client’s business or real estate risk.

- The real estate agent helped them buy a property without considering how it fits into their retirement strategy.

- The CPA saved them some tax last year but never had a forward-looking conversation about using an LLC or different entity structure.

- The investment advisor built a portfolio but never looked at the client’s other assets and income sources.

No one was wrong—they were just working in their own lane.

But wealth and retirement don’t happen in lanes. They happen in a real life where all these pieces cross over each other every day.

That’s why I’ve moved toward acting as an integrator—someone who looks across all four pillars and helps clients build a plan that actually works together.

How I Work With Clients: From Pieces to a Blueprint

The way I put this into practice is through a process I call the Real-Life Wealth Blueprint™ Session.

While details can vary, the core steps look like this:

- Discovery & Diagnosis We look at:

- Pillar Scorecard I show you—in plain language—how strong each of your four pillars is:

- Blueprint Design We outline a realistic, step-by-step path to:

- Action Plan You walk away with a prioritized list of actions and options, not generic “you should save more” advice.

Sometimes I stay involved long-term as an ongoing advisor and guide. Sometimes people simply use the blueprint to make better decisions with their existing professionals. The key is: they finally see the whole picture.

Why This Matters Now More Than Ever

The world is changing fast:

- Jobs are less stable.

- Healthcare costs continue to rise.

- Housing and rent are expensive in many places.

- Markets can be volatile.

- Laws and tax rules shift regularly.

Relying solely on “work hard, contribute to your 401(k), and hope for the best” is not enough anymore—especially if no one is thinking about your insurance, real estate, business potential, and tax structure together.

A Real-Life Wealth Blueprint doesn’t guarantee that nothing bad will ever happen. But it does dramatically increase your:

- Resilience (you can take hits and keep going).

- Flexibility (you have more options).

- Clarity (you know how each part of your financial life supports the others).

An Invitation

If you’ve ever felt like:

- You have “stuff” (accounts, policies, properties) but no coherent plan.

- Your insurance, real estate, and investments feel disconnected.

- You’ve wondered whether an LLC or side business could help your long-term wealth and taxes.

- You’re not sure your current retirement path is truly safe…

…I’d invite you to start a conversation.

I’m currently offering FREE 30 Minute Consultations of Real-Life Wealth Blueprint™ Sessions for people who want to see where they stand across the four pillars and what’s possible when everything is designed to work together.

On LinkedIn: you can send me a direct message with the word “Blueprint”. On my website: you can [link to your contact/booking page] to request a session.

You don’t need another random financial product. You need a blueprint that fits your real life.

Share this article with those that may benefit from the information.