Mastering Money: Lessons from the World’s Top Financial Minds

Mastering Money: Lessons from the World’s Top Financial Minds

Money impacts every aspect of our lives—our choices, relationships, health, and future. Whether we view it as a tool for freedom or a source of stress, understanding money and how to manage it is key to creating a life of purpose and security.

In this newsletter, we’ll dive into actionable lessons from financial experts like Dave Ramsey, Robert Kiyosaki (Rich Dad Poor Dad), and Suze Orman, exploring their philosophies and strategies for achieving financial independence and building generational wealth.

These are coaches I follow and listen to and now teach the strategies . I believe "CASH RULES EVERYTHING AROUND ME". I hope you take this year seriously and let's work together to creating "YOUR FREEDOM MACHINE".

Key Lessons and Strategies:

1. Dave Ramsey: Debt-Free Living and the Power of Baby Steps

- Philosophy: Money is a tool, not the goal. Achieve freedom by eliminating debt and building wealth.

Actionable Strategies:

- ✅ Start an emergency fund with $1,000 to cover unexpected expenses.

- ✅ Use the Debt Snowball Method: List debts smallest to largest, pay off the smallest first, then roll payments to the next.

- ✅ Save 3–6 months’ worth of expenses in a fully funded emergency fund.

- ✅ Invest 15% of your income in retirement accounts (401k, Roth IRA).

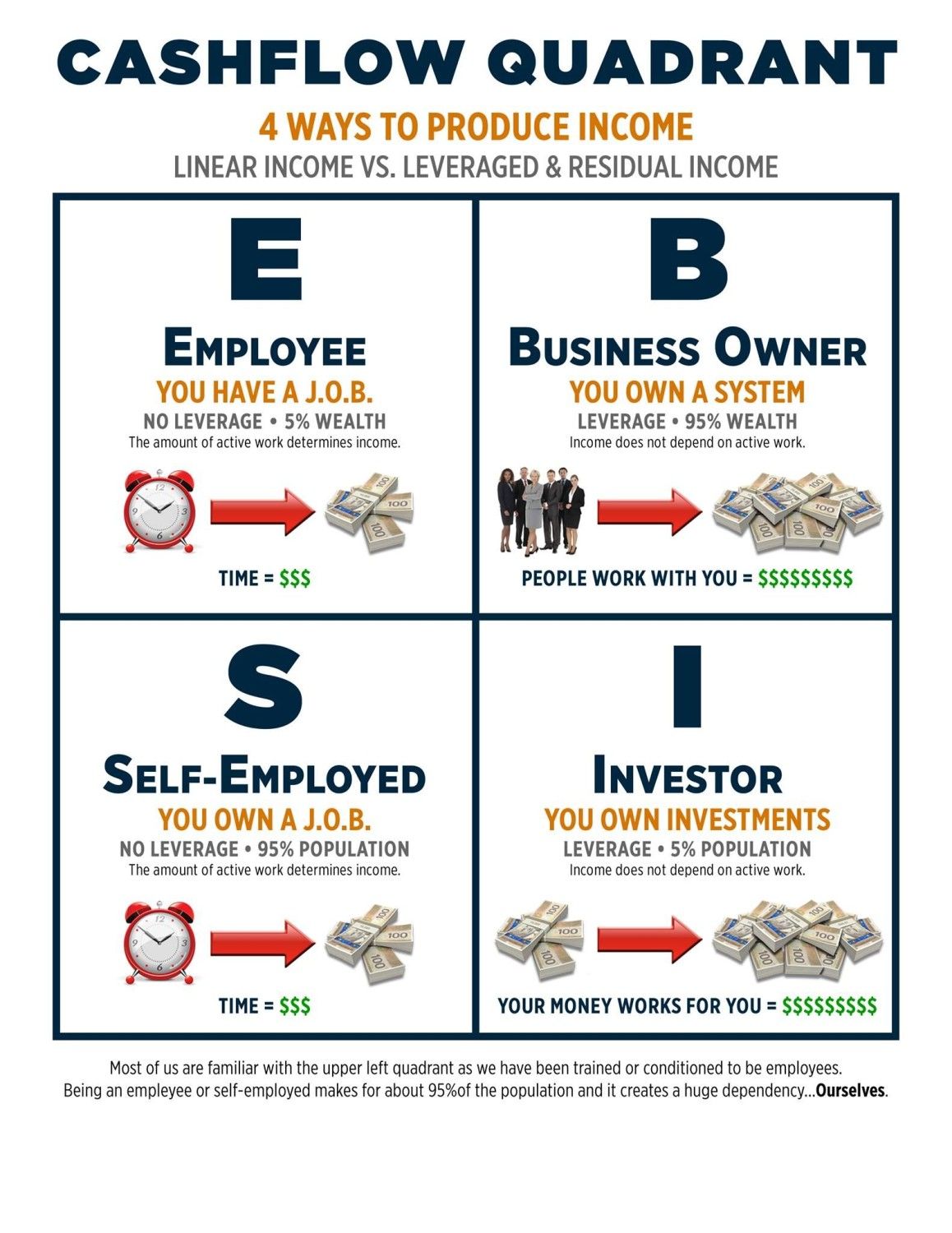

2. Robert Kiyosaki: Build Wealth with the Right Mindset

- Philosophy: Focus on assets that generate cash flow and rethink the traditional "work hard, save, retire" model.

Actionable Strategies:

- ✅ Identify and invest in income-generating assets: Real estate, stocks, or businesses.

- ✅ Create a side hustle or small business to build multiple income streams.

- ✅ Reduce reliance on a paycheck by increasing passive income.

- ✅ Keep track of your financial knowledge—invest in education about finance and investing.

3. Suze Orman: Financial Security and Empowerment

- Philosophy: Financial independence is the ultimate form of empowerment, especially for women.

Actionable Strategies:

- ✅ Automate your savings: Set up direct deposits to a high-yield savings account.

- ✅ Diversify your investments: Mutual funds, bonds, ETFs, and other low-risk options.

- ✅ Ensure you’re insured: Health, life, disability, and home insurance are crucial for long-term security.

- ✅ Plan for long-term care as part of your retirement strategy.

Practical To-Do Lists for Saving, Making, and Investing

Saving Money

🔲 Set a realistic monthly budget using the 50/30/20 rule:

50% for essentials (rent, bills).

30% for wants.

20% for savings and debt repayment.

🔲 Cancel unused subscriptions and negotiate lower rates for bills (utilities, phone plans).

🔲 Open a high-yield savings account for your emergency fund.

🔲 Practice a spending freeze for one week a month—only spend on essentials.

Making Money

🔲 Start a side hustle (e.g., freelance, sell products online, offer a service).

🔲 Learn a high-demand skill (e.g., copywriting, coding, graphic design).

🔲 Rent out unused space or items (storage rooms, cars, tools).

🔲 Leverage your network to find new opportunities for additional income streams.

Investing Money

🔲 Open a retirement account (401k, Roth IRA) and max out contributions.

🔲 Invest in low-cost index funds or ETFs for long-term growth.

🔲 Start small with fractional investing platforms like Robinhood or Acorns.

🔲 Research and invest in real estate (REITs, rental properties).

🔲 Consider investing in your skills through courses, certifications, or mentorship.

How Money Affects Everything in Our Lives

- Relationships: Financial disagreements are a leading cause of conflict. Aligning on goals can create stronger partnerships.

- Health: Financial stress can negatively impact mental and physical health. Security leads to peace of mind.

- Freedom: A solid financial foundation allows for travel, passion projects, and time with loved ones.

Inspirational Leaders to Follow for More Insights

- Tony Robbins (Unshakeable): A guide to achieving financial confidence.

- Ramit Sethi (I Will Teach You to Be Rich): Conscious spending and practical strategies.

- Barbara Corcoran (Shark Tank): Scaling small businesses into big successes.

Action Steps for This Week:

✅ Evaluate your current budget and spending habits.

✅ Identify one expense you can cut or reduce.

✅ Research one new income opportunity or side hustle.

✅ Start learning about one investment option you’re not currently using.

Money doesn’t have to control your life—it can be a tool to build the life you want.

Whether you’re starting your journey with Ramsey’s Baby Steps, creating passive income streams with Kiyosaki, or planning for security with Orman, take that first step today.

What’s your top financial goal this year? Reply in the comments and let us know!

If your wanting to Join Our FREE Community To Learn More about making money, saving money, investing, real estate, business, marketing and so much more:

STRART YOUR FREEDOM JOURNEY:

CLICK HERE

Learn How You Can Strart Your Online Business:

GET STARTED