How the Current Financial System Works (in plain English)

📊 How the Current Financial System Works (in plain English)

📌 Overview of My Thoughts on the Current Financial System and Its Global Impact

For decades, we’ve been conditioned to believe the financial system was designed to serve the people — to help us buy homes, start businesses, build wealth, and create security for our families. The truth is, it was never built for us.

The global financial system is debt-based, interest-driven, and inflation-prone — intentionally designed to concentrate wealth and control in the hands of a small percentage while the rest of the population stays trapped in cycles of debt, dependence, and financial confusion.

🔍 How It Really Works:

Money is created out of debt, not value. Every time a loan is approved, new money is created — not from reserves, but from a digital entry.

Inflation is built into the system, silently eroding the purchasing power of every paycheck, savings account, and retirement plan.

Interest payments and debt obligations consume the average person’s income, leaving little room for wealth-building or independence.

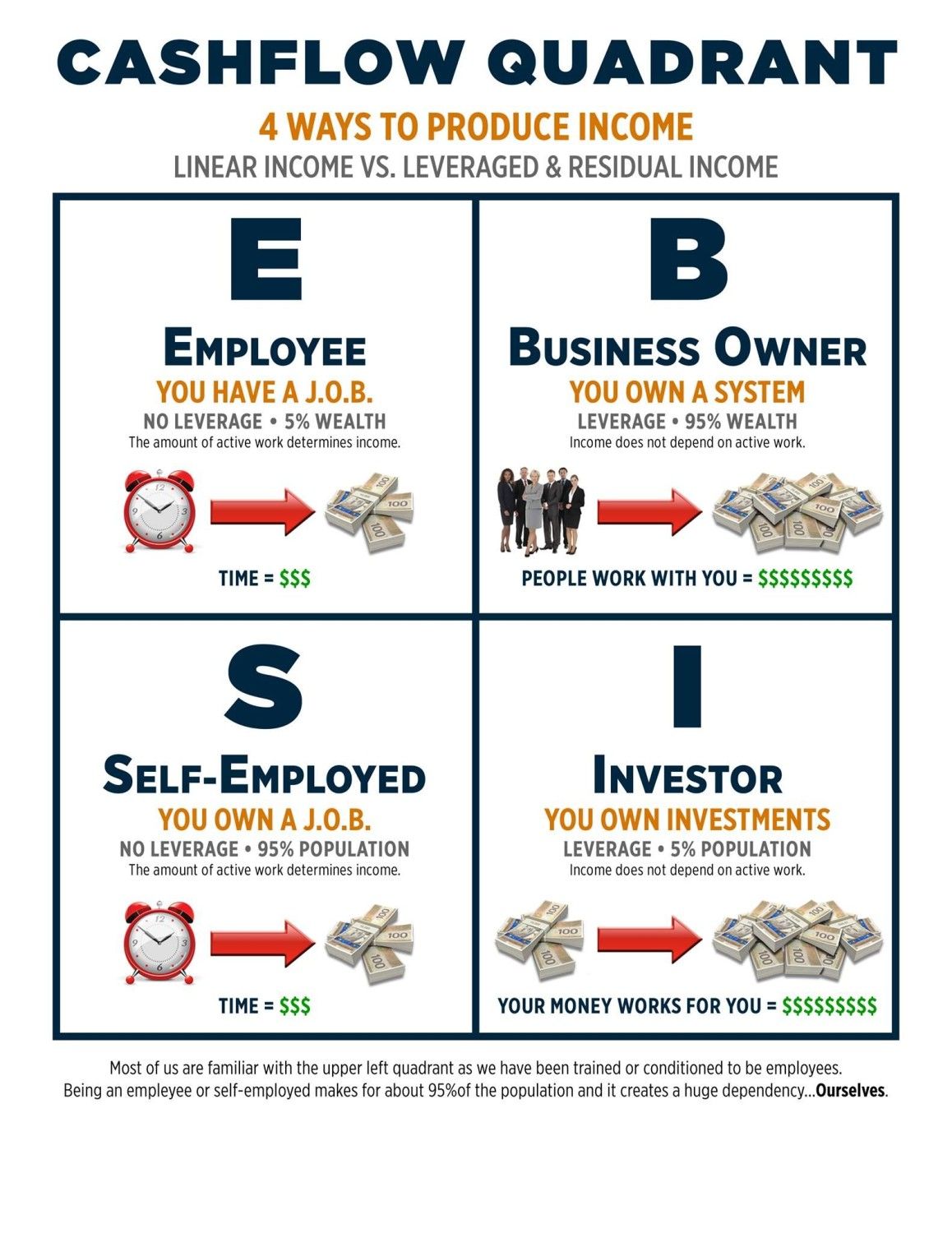

The rules of money favor those who own assets, not those who trade time for dollars.

🌍 How This Affects Every Person in the World:

No one is immune. Whether you live in the United States, Europe, Africa, or Asia — your economy is tethered to central banks, fiat currency, and a system of perpetual debt.

- Home ownership comes with 15-30 year mortgages where you often pay 2-3 times the value of your home.

- Vehicles, financed on 6-7 year loans, depreciate faster than you can pay them off.

- Consumer credit cards carry 20-30% interest rates, locking millions in endless cycles of payments.

- Inflation raises the price of food, fuel, and housing — while wages rarely keep up.

- National debts in every major country rise uncontrollably, passing the burden onto future generations.

⚠️ The Deeper Cost:

Beyond the financial strain, the system extracts something even more valuable:

- Freedom of choice

- Peace of mind

- Time with family

- Opportunities for future generations

People stay in jobs they hate, delay dreams, and live stressed lives trying to keep up with payments on money that was created with the stroke of a pen.

✊ How We Fight Back:

The system thrives on ignorance and compliance. We fight back by understanding how it works, opting out where possible, and teaching others to do the same.

- Eliminate high-interest consumer debts

- Own assets, not liabilities

- Invest in income-producing vehicles

- Use business and tax strategies the wealthy use

- Create local and online communities for financial education and mutual support

- Challenge politicians and institutions perpetuating financial exploitation

💡 FACT

The system isn’t broken — it was built this way. But for the first time in history, thanks to technology, decentralized finance, and a growing wave of financial literacy, the people have the power to unplug from this rigged game.

We can choose to reclaim control of our homes, cars, businesses, and futures.

The future doesn’t belong to the bankers — it belongs to the people bold enough to learn the rules, and then write their own.

Watch the video below that shares a very detailed overview of "HOW THE FINANCIAL SYSTEM WORKS".................

The U.S. financial system (and most of the world’s) is debt-based and operates on a fiat currency model.

Here’s what that means:

- The Federal Reserve (a private central bank) controls the creation of money — not Congress, not you and me.

- Money isn’t backed by gold or silver anymore (since 1971 when Nixon took us off the gold standard). It’s backed by debt and the government’s "promise to pay."

- When banks give loans (home loans, car loans, credit cards) — they don’t lend you money they have. They create new money through bookkeeping entries. The money didn’t exist until you signed the paperwork.

- Interest rates are set to control inflation and economic activity — meaning the Fed uses interest rates like a lever to speed up or slow down the economy. When rates are high, borrowing slows. When rates are low, borrowing and debt creation explode.

- The IRS and tax code are structured in ways that primarily benefit the wealthy who understand and use things like depreciation, business deductions, and tax shelters.

- Most people spend their lives working for dollars that lose value over time (inflation) while paying interest on debts created out of thin air.

🧐 Is it Fraud?

Is it technically illegal? No — because the rules were designed this way by the financial elite over generations. Is it unethical, exploitative, and deceptive to the average citizen? Arguably yes.

The system preys on financial illiteracy. It incentivizes debt, consumerism, and dependence on a system that enriches a small percentage while keeping the majority enslaved to monthly payments.

💥 How Can Americans Fight Back and Take Control?

The system won’t fix itself. But individuals can opt-out and play a different game. Here’s how:

🏡 Retain Control of Homes & Cars:

- Pay down debts aggressively starting with highest interest first (Debt Avalanche method)

- Refinance mortgages strategically when rates drop

- Avoid financing depreciating assets (like cars) when possible — buy reliable used cars cash

- Understand homestead exemptions and legal protections for your primary residence in your state

💳 Eliminate Debts and High Interest:

- Stop using credit cards unless you pay them off in full each month

- Negotiate lower rates with creditors or do 0% balance transfers

- Use debt consolidation loans cautiously — only if total interest costs go down

- Consider side hustles or freelance work dedicated solely to paying off debt

- Use business structures (LLCs, S-Corps) to legally redirect taxable income into deductible expenses

💡 Build Financial Power:

- Invest in assets that produce income (real estate, small businesses, dividend stocks)

- Learn how to use debt like the wealthy — borrowing against appreciating assets, not for consumption

- Educate yourself on the tax code — knowledge is a financial weapon

- Join or build local community finance groups to share strategies, barter services, and invest together

- Support political and local candidates who advocate for decentralization and financial literacy

🔥 Big Picture:

We don’t need to wait for a political revolution. A financial literacy revolution would quietly dismantle the old system one household at a time. The rich don’t fear protests — they fear people waking up, opting out of their debt traps, and becoming financially sovereign.

✊ Final Thought:

The system isn’t broken — it was built this way. But you don’t have to play by their rules.

Learn More:

CLICK HERE

Learn More:

SUBSCRIBE