A Comprehensive Cash-Flow Playbook for Small Businesses

Make every dollar work harder, today

Cash flow is oxygen for your business. Profit looks good on paper, but cash keeps the lights on, pays your team, and fuels growth. This playbook gives you clear, practical steps to understand, forecast, and improve cash flow—so you can move from reactive to confident.

What is cash flow?

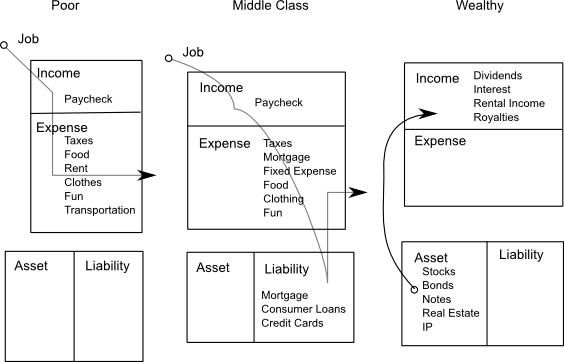

- Cash flow is the net movement of money in and out of your business over a period. Positive cash flow means more cash comes in than goes out. Negative cash flow means the opposite—and if it persists, even profitable businesses can fail.

- Operating cash flow: Cash from your core business (sales collected minus operating expenses).

- Investing cash flow: Cash from assets and investments (equipment purchases, etc.).

- Financing cash flow: Cash from loans, credit lines, and owner distributions.

Why cash flow matters

- Keeps you alive: You can’t pay vendors or payroll with “future revenue.”

- Builds resilience: Buffers seasonality and shocks.

- Unlocks growth: Funds inventory, marketing, and hiring at the right time.

- Improves valuation: Healthy cash flow signals a well-run, lower-risk business.

The 12 Moves That Tighten Cash Flow Fast

1. Shorten your cash conversion cycle

- Reduce days sales outstanding (DSO): Invoice immediately on delivery. Offer 1–2% early-pay discounts selectively for reliable clients. Require deposits or milestone billing on larger projects. Automate reminders at 3/7/14 days past due.

- Reduce days inventory outstanding (DIO): Forecast demand and set par levels. Trim slow movers; run liquidation campaigns quarterly. Negotiate smaller, more frequent orders to avoid overstock.

- Extend days payables outstanding (DPO): Ask for net-45/net-60 once you’ve proven reliability. Batch vendor payments on fixed days to maintain control. Use corporate cards or virtual cards where sensible

2. Ruthlessly fix your invoicing system

- Standardize invoices (clear terms, due date, late fee policy, payment options).

- Send digitally with embedded payment links.

- Add late fees (e.g., 1.5%/month) and enforce them.

- Create a “collections playbook” with scripts and escalation.

3. Forecast 13 weeks ahead

- Build a rolling 13-week cash forecast (inflows, outflows, weekly ending cash).

- Stress test: What if revenue dips 20%? What if a major client pays 2 weeks late?

- Trigger rules: If projected cash dips below $X, delay non-critical spend or pull credit.

4. Tier your customers by risk and behavior

A/B/C your accounts receivable:

- A: On-time, high volume → reward with small perks.

- B: Occasional late → nudge with reminders and early-pay incentives.

- C: Chronic late → prepayment, deposits, or pause service.

- Set credit limits by customer, not by hope.

5. Turn payments into a growth lever

- Offer multiple methods: ACH, card, wallet, bank transfers.

- Use payment links and QR codes on every quote, invoice, and email signature.

- For subscriptions or retainers, default to autopay.

6. Renegotiate everything

- Vendors: Ask for longer terms or early-pay discounts (pick one per vendor).

- SaaS: Annual prepay for 10–20% savings if cash allows; otherwise downgrade unused seats.

- Shipping/3PL: Re-bid quarterly if volume shifts.

7. Make inventory pay rent

- Assign a “cash rent” to SKUs (e.g., 2% per month of cost). Any item that can’t “pay rent” is discounted or discontinued.

- Bundle slow movers with fast movers.

- Use preorder or waitlist campaigns to validate demand before restocking.

8. Align pricing with cash realities

- Raise prices on low-margin, high-support products first.

- Introduce good/better/best tiers to capture willingness to pay.

- Add rush fees and minimum order fees to protect time and cash.

9. Weaponize your calendar

- Payroll cadence: Align major bills after known inflows.

- Payment runs: Pay bills twice weekly to avoid drip-drain.

- Sales sprints: Run cash-boosting promos in low-cash weeks.

10. Keep a cash cushion and a credit backstop

- Target 2–3 months of operating expenses in reserve.

- Maintain a line of credit before you need it; test it quarterly.

- Separate tax money in a dedicated account; treat it as untouchable.

11. Systematize expense controls

- Implement spend limits and approvals on company cards.

- Zero-based budgeting each quarter: every line must re-earn its place.

- Kill zombie spend: monthly audit for tools not used in 30+ days.

12. Build a simple cash culture

- Share a one-page “cash scoreboard” with leadership weekly.

- Celebrate DSO improvements like you would new deals.

- Train managers to think “cash impact” before “budget available.”

How to build your 13-week cash forecast in 45 minutes

- Start with current bank balance.

- List weekly expected inflows: Recurring subscriptions/retainers Pipeline deals with probability-weighted timing AR with realistic collection dates (not due dates)

- List weekly outflows: Payroll, rent, loan payments COGS tied to forecasted sales Software, marketing, taxes, owner draws

- Calculate weekly ending cash; flag negative weeks.

- Add levers next to each week: Pull forward collections Delay discretionary spend Run a promotion Draw on LOC

Tip: Update every Friday; share Monday morning.

Templates and scripts you can copy

Invoice terms (drop-in)

- Terms: Net 15

- Early pay: 1% if paid within 7 days

- Late fee: 1.5% per month after due date

- Payment: ACH, card, or bank transfer via link

- Disputes must be submitted within 5 business days

Collections sequence

- Day 1 overdue: Friendly reminder + payment link

- Day 7: Second reminder + offer early-pay discount if paid within 48 hours

- Day 14: Phone call + late fee notice

- Day 21: Service pause notice

- Day 30: Final notice + handoff to collections or legal

Vendor terms ask (email)

- “We value our partnership and plan to increase volume this quarter. Could we move to Net 45 to align with our client payment cycles? In return, we can commit to a monthly order schedule and on-time payments.”

Common cash-flow pitfalls (and fixes)

- Growth without cash plan: Rapid sales eat cash via inventory and receivables. Fix: Preorders, deposits, staged billing, LOC.

- Single-customer dependence: One late payer sinks you. Fix: Credit limits, diversification, cash buffer.

- Hope-based forecasting: Counting on unsigned deals. Fix: Probability-weight the pipeline; only include likely collections.

- Inventory vanity: Too many SKUs tying up cash. Fix: SKU-level margins, rent rule, quarterly pruning.

- Hidden seasonality: Cash crunches every Q1/Q3. Fix: Calendarized promos, terms negotiation ahead of dips.

Metrics that matter

- DSO: Target improvement trend, not perfection.

- DIO and inventory turns: Fewer days, higher turns.

- Gross margin after payment fees: Optimize payment mix.

- Operating cash flow margin: Cash from operations / revenue.

- Cash runway: Months until zero at current burn.

Quick wins you can do this week

- Add payment links and QR codes to every invoice and quote.

- Switch two largest clients to milestone billing or deposits.

- Ask top three vendors for Net 45 or a 2% early-pay discount.

- Audit subscriptions; cut or downgrade at least two.

- Launch a “pay now, deliver next” pre-sell for a proven SKU/service.

- Build and share your 13-week cash forecast.

Final word

Cash flow isn’t just bookkeeping—it’s strategy. When you design your operations, pricing, and customer experience around cash velocity, you gain the freedom to make smarter moves, faster.

7 Day Free Trial and Free Coaching: CLICK HERE

Learn more about OUR SERVICES AND WE CAN HELP YOU: CLICK HERE

JOIN OUR COMMUNITY: CLICK HERE