Unexpected Factors That Can Sabotage Your Credit Score

Rene' Manfre

Unexpected Factors That Can Sabotage Your Credit Score

If you're in the market for a new home and considering a mortgage, it's important to understand that your credit score plays a significant role in determining your buying power and the terms of your loan. While you might already be aware that late or missed credit card payments can harm your credit score, there are other surprising factors that can influence it. Here's a list of these unexpected credit score saboteurs to ensure you're not unintentionally jeopardizing your chances of buying a home.

Saboteur #1

Closing old credit card accounts

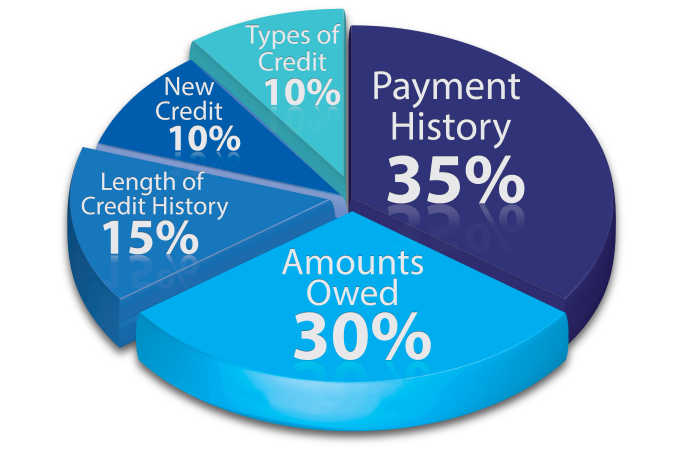

Closing unused credit card accounts can negatively affect your credit score. It can impact your debt-to-credit utilization ratio, which accounts for 30% of your credit score.

By closing an old credit card, you reduce your available credit, making it harder to maintain a favorable debt-to-credit utilization ratio and diminishing your credit history's average length, which lenders value.

Avoid closing old credit card accounts.

Saboteur #2

Opening a new credit card

Applying for a new credit card can result in a minor reduction in your credit score (up to 5 points) due to a "hard inquiry" on your credit report.

For individuals near the threshold of having a good or excellent credit score, this reduction could push them into a lower credit category, affecting their ability to secure the best interest rates on a mortgage.

Avoid applying for new credit cards shortly before seeking a home mortgage.

EXPERT TIP

Frequently reviewing your credit reports is crucial to ensuring the accuracy of your personal and account details, as errors can negatively impact your credit score. You have the option to obtain a complimentary copy of your credit report from all three major credit bureaus through annualcreditreport.com.

In the event that you identify an inaccuracy, you can contest the error with the reporting bureau. It's important to be vigilant for common errors such as misspelled names, incorrect account statuses (e.g., being reported as late or delinquent when it should be in good standing), or inaccuracies in outstanding balances.

Saboteur #3

Not using your credit cards

While responsible credit card usage is essential, letting your cards remain unused for an extended period, typically six months, can lead to the account's closure by the issuer. This closure reduces your average credit history length, harming your credit score.

To keep your credit cards active, charge a purchase at least once every four months and pay it off in full.

Saboteur #4

Failing to pay medical bills

Unpaid medical debt may be outsourced to debt collection agencies, who may report your delinquency to credit bureaus, significantly impacting your credit report.

Being proactive and arranging a payment plan with your medical provider can help mitigate this issue.

Saboteur #5

Co-signing a loan

Co-signing a loan makes you responsible for the debt if the primary borrower defaults, affecting your credit score. Be cautious when considering co-signing for others.

Saboteur #6

Missing payments on a business credit card

Owners of businesses with credit cards for expenses should be aware that their business activities can influence their personal credit history.

Any default or late payment on a business credit card can be reported to credit bureaus, negatively affecting your credit score. Even applying for a business credit card can temporarily lower your score.

In conclusion, it's crucial to be aware of these lesser-known factors that can impact your credit score when preparing to purchase a home. Taking steps to manage and improve your credit can significantly benefit your home-buying journey.

Questions about how to get your credit score up so you can buy a home?